Tips to keep your Paytm Payments Bank account safe

SIM Swap

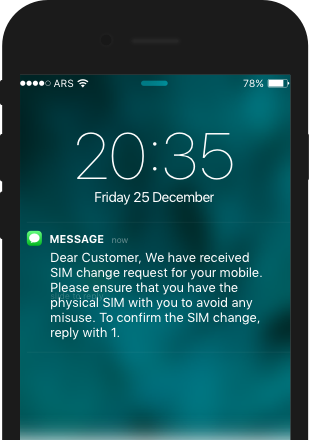

When fraudster manages to register your existing mobile number on a new SIM card, then such a fraud attempt is called SIM SWAP.

How does one commit it?

Fraudsters gather your personal information through Phishing, Vishing, Smishing or any other means. They then approach the service provider (posing as you, with fake papers), claiming that the mobile handset or sim card (which is actually your number) is lost. The mobile operator deactivates the genuine SIM card (which is in your mobile) and issues a new one to the fraudster. Since your SIM has no network, all your password reset links, verification codes, banking alerts, OTPs and other financial transactions details are received on the new SIM held by the fraudster.

Examples

How to save myself from SIM Swap?

Do's

- Enquire with your mobile operator if you have no network connectivity and you are not receiving any calls or SMS for unusually long periods.

- Keep your mobile bills private and shred them after use.

- Also, destroy any such unusable piece of paper/photocopies/photographs holding details of your identity or financial information.

- Always inform the mobile network provider company about the change of address, so that the bill is dropped at your current location.

Dont's

- Do not neglect messages sent from your network provider that highlight a probable SIM-Swap or MNP request.

- Do not share your MNP UPC (unique porting code) with anyone other than network provider's point of sale.

- Never switch off your smartphone in the event of you receiving numerous unknown calls. It could be a ploy to get you to turn off your phone and prevent you from noticing a tampered network connection.