Join the Revolution.

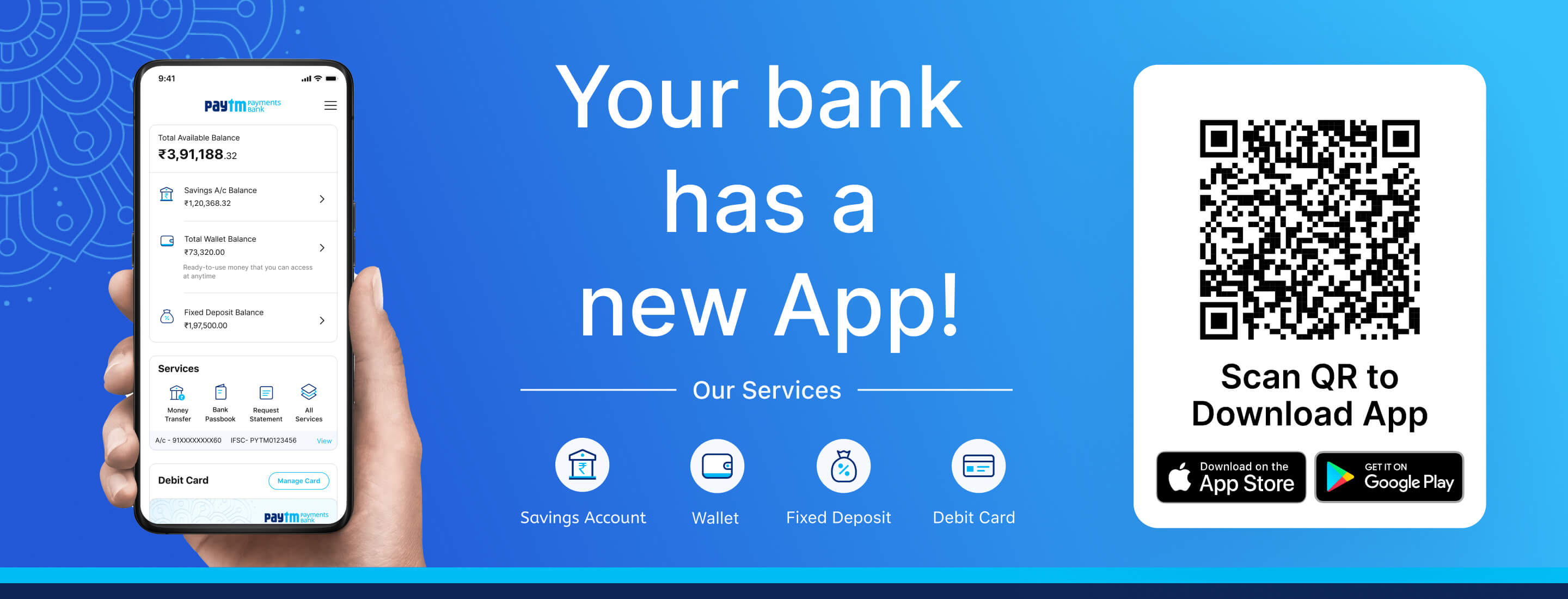

Start your Digital Savings Account today!

Paytm Payments Bank offers a Savings Account with no account opening charges or minimum balance requirements. Keep upto Rs. 2 lac of deposits and enjoy benefits like:

No account fees and charges

No account fees and chargesEnjoy the convenience of banking on your phone and no charges for online transactions

Risk-free deposits

Risk-free depositsYour money is safe with us. We invest deposits only in government bonds. None of your deposits will be converted in to risky assets.

VISA Debit Card

VISA Debit CardUse your free virtual card to make online purchases across all merchants accepting VISA cards. You can order a physical debit card through the Paytm Payments Bank section of your Paytm App

Earn interest every month

Earn interest every monthEarn an interest of 2% per annum, payable monthly effective 1st August,2023

Real time updated Passbook

Real time updated PassbookView your transaction and balance in real time in Passbook

Highly Secure

Highly SecureYour account is secured with a special Passcode to ensure your account is safe

Say hello to your

Paytm Payments Bank Debit & ATM Card

Every Paytm Payments Bank account holder will be issued a free Digital Debit Card at the time of account opening. Account holders can request for a physical Debit Card through the Paytm Payments Bank section of their Paytm App

Contactless transactions

Enjoy smart contactless Tap to Pay transactions.

Cashback and offers

Enjoy discounts and cashbacks across a large number of merchants with your

Wide acceptance

VISA is the largest acceptance network in the world

Withdraw cash from any ATM

Withdraw cash at more than 2,00,000 ATMs across India & Abroad

Trust and Security

Do safe and secure transactions 24x7

Queries regarding recent RBI directive.

The Reserve Bank of India (RBI) has issued a directive restricting Paytm Payments Bank Account/Wallet from accepting new deposits or allowing credit transactions after March 15, 2024.

Please note that you will not be able to deposit or add money to your Paytm Payments Bank Account/Wallet after March 15, 2024. However, there is no restriction on withdrawal of money from your existing balance even after March 15, 2024.

The directive does not impact your existing balances in Account or Wallet and your money is safe with your Bank.

All your questions answered

To complete full KYC of your PPBL account, you need to complete in-person verification by visiting a nearby KYC center. To become a KYC user, please follow the link below: