Language

Safety and Security

Beware of Dubious Schemes

- Never respond to unsolicited offers of money received through emails/phone/other media*

- No one really gives you money for free*

- Be careful while investing in seemingly attractive schemes offering high returns*

- Don’t invest in unregulated companies/entities*

- Don’t rely on hearsay - Check for yourself*

- High return means higher risk including potential loss of entire money - Check your risk-appetite!*

- Take care of your money - it is hard to earn but easy to lose*

- When in doubt check with a trusted financial advisor*

- * For any clarification/details, visit www.rbi.org.in or www.sebi.gov.in or www.irda.gov.in

![]() Do’s

Do’s

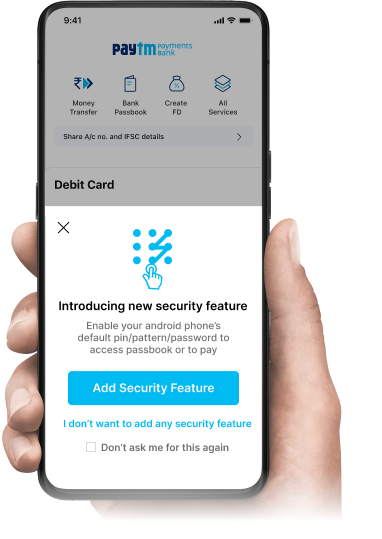

- Protect the mobile phone via password.

- Set a maximum incorrect password input limit.

- Look for https while logging in the Bank website.

- Employ a strong password for Login. E.g. Use special characters, numbers etc. in the password.

- Update/change your passwords and passcode at regular intervals.

- Verify transactions in account statements regularly.

- Verify transaction communication received via SMS.

- Use nomination facility.

- Immediately intimate the Bank/Branch for:

- Change in address/mobile number.

- Erroneous/unauthorised transaction.

- Loss of Debit Card/Demand Draft etc.

- Report lost/stolen phone to service provider/police.

![]() Don’t

Don’t

- Never transfer funds without validation of recipient.

- Never share the Login details/PIN/OTP/Transactions IDs/Passcode/Confidential information over phone/internet/hand over ATM Cards to third parties.

- Do not store any sensitive information such as passcode, password, debit card details, etc. in a folder on phone/computer or on paper etc.

- Never forget to intimate us for change in address/mobile number to avoid misdelivery of transaction communication.

- Never click on embedded links from unknown sources on social networking sites / emails.

- Employ caution on using Bluetooth in public places

Safe Banking Practices

- Personal computer and mobile phone should be regularly updated with anti-virus software, e-mail filters, spyware filters and firewall programs.

- Never conduct financial transactions from public Wi-Fi or internet cafe computers as they can be unsafe. Avoid using unsecure or unknown Wi-Fi networks as they can distribute malicious applications.

- Use licensed software in your devices. Software obtained from unofficial and untrustworthy sources can corrupt your files and reveal confidential data.

- Mobile Banking is to be done by the account holder only. Never hand over your phone to any 3rd party after entering PIN, password or any other form of self-authentication.

- Make sure that no one sees you entering PIN for mobile Banking or ATMs and avoid assistance from strangers. Be aware of shoulder surfers while typing confidential information on your devices in public places.

- Be cautious of any mail, SMS, or phone call asking for your personal or financial information or asking you to upload it in any website. Contact your Bank directly to confirm the authenticity of these communications.

- Always log out after completing your transaction done through internet or mobile banking. Close the window or app after completion.

- Do not install or download applications from unverified sources in your mobile or computer. Always use official and trusted sources like Google Play Store and App Store for installing applications in your mobile.

- Always protect your devices including personal computers and mobile phones with a strong password, PIN or pattern. Ensure to update it regularly.

- Keep the operating system and applications in your devices regularly upgraded with the latest security updates.

- Turn off Bluetooth and Wi-Fi in your devices when not in use. Bluetooth can be used in hidden mode so that other devices cannot recognize yours and pair to it without your knowledge.

- When you are finished with your Banking session, be sure to completely delete cached images/files, cookies, browsing history and other similar data.

- If you need to leave the computer, sign out of all your Bank accounts and close all windows that contain sensitive information as someone might use the computer in your absence and easily access your account.

- Review and modify your privacy settings on all your devices, apps and social media profiles to reduce the amount of your personal data being shared online.

- Look for indicators of a secure connection, such as “https://” and a padlock icon in the address bar, before entering any payment information. This indicates that the website is using SSL encryption to protect your data.

- Ensure to use the facility provided by banks to switch on/off and set/modify card limits for PoS/ATMs/online/contactless transactions. This can be done for all types of transactions – both domestic and international.