Join the Revolution.

Start your Digital Savings Account today!

Paytm Payments Bank offers a Savings Account with no account opening charges or minimum balance requirements. Keep upto Rs. 2 lakhs of deposits and enjoy benefits like:

Know MoreNo account fees and charges

Enjoy the convenience of banking on your phone and no charges for online transactions

Risk-free deposits

Your money is safe with us. We invest deposits only in government bonds. None of your deposits will be converted in to risky assets.

Free Virtual Debit Card

Use your virtual debit card to make effortless online transactions at your favourite merchants across the world. You can also order a physical card for Instore and ATM transactions at a minimal charge of Rs.250

Earn interest every month

Earn an interest of 2% per annum , payable monthly effective 1st August,2023

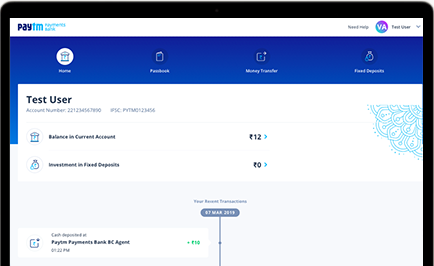

Real time updated Passbook

View your transaction and balance in real time in Passbook

Highly Secure

Your account is secured with a special Passcode to ensure your account is safe

Experience The Power Of

Corporate Salary Account

Banking made simple, secure and now at your fingertips

Benefits for Corporate

Instant Account Opening

Enjoy hassle free and swift onboarding of employees.

Employee Management Panel

Get information about your employee's salary account status realtime from our panel.

Faster Corporate Onboarding

Onboarding complete in a single visit by our representative

Dedicated Relationship Manager

Our representative is a phone call away for your end to end support.

Benefits for Employees

Life time free Account

- No Account opening fee - No minimum balance - Free transactions

Enjoy complimentary virtual debit card

Enjoy free virtual and physical debit card

Earn upto 7.75% on Fixed Deposit

Redeem fixed deposit instantly in a single click

FD with Partner Bank

Highly secure business and transactional details

Backed by highly secure infrastructure and two-factor authentication.

No account fees and charges

All the convenience of banking with no charges for online or offline transaction

Instant alerts and real-time updated passbook

Get immediate alerts for any transaction from your current account

Monitor your funds through Corporate banking panel

Enjoy the privilege of 24 hour Netbanking to check account, user and transaction details.

Click here to login

Paperless and easy onboarding

Open your Current Account in minutes.

Say hello to your

Paytm Payments Bank Debit Card

Every Paytm Payments Bank account comes with a free Digital Debit Card to pay online. Order your physical Debit Card to withdraw cash from ATMs and pay at stores across India!

Effortless Activation

With just a few clicks on your app, activate your card anytime, as per your convenience.

Instant PIN Change

Does someone know your ATM PIN? Don't worry. Change your PIN instantly from your phone anytime.

Temporary Card Block

Say Goodbye to unwanted customer care calls and doubts! Temporarily block your card from your App in a second.

Limit Update

From your App, adjust your daily spend limit as per your requirement.

Card Settings

Different needs? Smartly enable or disable transaction channels for your Debit Card, from your App.

Unlimited ATM Withdrawals

Make countless transactions at Paytm Payments Bank ATMs. Moreover, avail ample withdrawals at other bank ATMs for free!

Visa Debit Card

Contactless transactions via VISA Physical card

Enjoy smart contactless Tap to Pay transactions that are faster and smoother.Cashback and offers

Enjoy discounts and cashbacks across a large number of merchants with your Visa card. Explore these offers now! Click for VISA Offers.Wide acceptance

VISA is the largest acceptance network in the world, use it at any online merchant or POS/ATM without any worries.Trust and Security

Do safe and secure transactions 24x7 with your VISA debit cardRupay Debit Card

Cashback and offers

Enjoy discounts and cashbacks across a large number of merchants with your Visa or Rupay Card. Explore these offers now! Click for Rupay Offers.Wide Acceptance

Swipe it at stores across India or pay for your online spends. Withdraw cash at more than 200,000 ATMs across India.Payments

Transfer funds and make payments to any bank across India

NEFT

National Electronic Funds Transfer is a nationwide funds transfer system. You can transfer funds to Paytm Payments Bank a/c from any account. Now there is no need to queue in a branch counter, deposit cheques or demand drafts, or wait for days for confirmation. Enjoy the convenience of transferring money 24 X 7 X 365.

IMPS

(Immediate Payment Service) is an instant real time inter-bank electronic fund transfer service which is available 24 hours a day, 7 days a week. The money is credited immediately into the beneficiary’s account. Thus, you can use this service to receive or send money any time during the day, even on Sundays and bank holidays.

UPI

Funds transfer just became more convenient, faster and safer. You can receive or send money using only your UPI id. There is no need to share any personal details like IFSC Code, account number or mobile number. Moreover, there is no need for beneficiary registration, and the transactions are authorized by a secret MPIN known only to you.

Know MorePaytm Payments Bank Wallet

Hassle Free Payments

The most seamless way to pay whether online or in store, just a click and its done

Accepted Online & In Stores

The most accepted Payment method with more than 6 Million merchants in our network

Auto Top Up

Auto top-up your wallet, to ensure you have the balance when you need

Receive Cashbacks in your Wallet

Receive Cashbacks from our Partners in your Wallet

Send & Receive Money for Free

Send Money or Accept Money from any Wallet User at no charge at all

Real time updated Passbook

View your transaction and balance in real time in Wallet Passbook

Send Money to Bank Account

Send money to any bank account with a nominal charge from your Wallet

Pre-Authorize a Transaction

Customers can pre-authorize trusted merchants to do a transaction on their behalf on fulfillment of a product/service.

No account fees and charges

Enjoy the convenience of banking on your phone and no charges for online transactions

Food Wallet

Provide tax free meal allowance to your employees Accepted by lakhs of merchants and used by thousands of employees

Benefits for Employers

Compliant

Meal benefit as per IT rule

Convenient

No hassle of procurement, handling and distribution of cards / vouchers

Effective

Do it yourself; Digital facility to send benefit instantly

Secure

Set user rights as per company policy; Bank and peer transfer not allowed

Benefits for Employees

Save Tax

Save tax while spending on food and beverages

Delightful

India's largest proprietary network of merchants; Exciting offers

Safe

No carrying cards or coupons; No risk of loss or expiry

Easy

Pay through mobile; Instant balance check; Locate stores in app

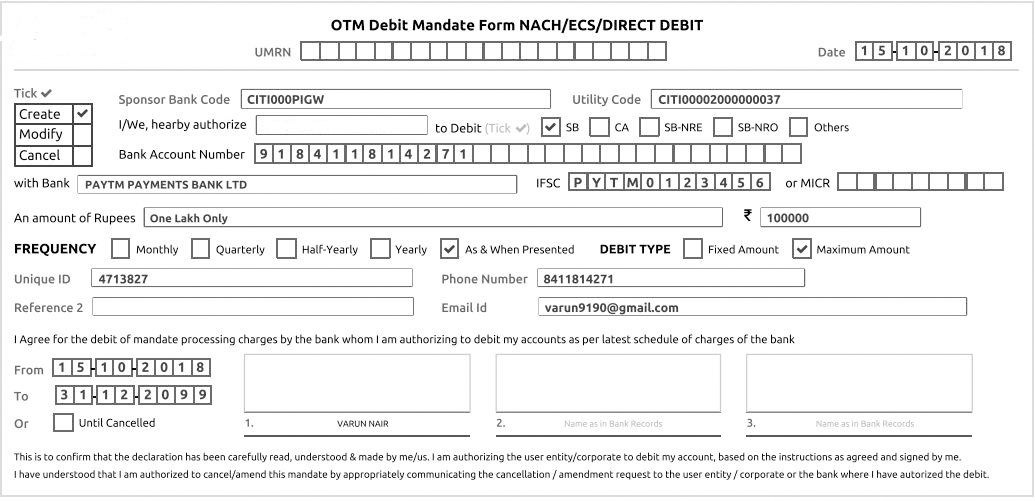

You can now automate your recurring payments such as EMIs, insurance payments, SIP deductions via NACH.

How do I set up a recurring payment on my Paytm Payments Bank Savings account?

- The service provider(such as Airtel, Paytm Money etc) will ask you to fill up a NACH Mandate form and sign it

- In the space provided for account number fill in your Paytm Payments Bank account number and in the space given for IFSC fill in "PYTM0123456"

- Within a few days, you will get a notification on your App which will ask you to authenticate the mandate using your passcode.

How do I authorize the mandate on my App?

- Once your mandate is active, the payment to the service provider will be automated at the desired frequency from your bank account.

- You can also view all your NACH mandates in the “NACH Mandate” Section on your App. This section will be visible to you only when you have an active mandate

Zip through Tolls!

Buy FASTag to enjoy a hassle free highway experience

RFID Technology

The tag employs Radio-frequency Identification (RFID) technology & is affixed on the vehicle's windscreen & lets you pass through the toll plaza without stopping at the cash counter

Ease of Use

FASTag is linked to a Paytm Payments Bank Wallet from which the applicable toll amount is deducted. FASTag balance can be checked by simply giving a missed call on 8860-058-048 or by logging into your App

400 +

More than 400 Toll Plazas

Funds transfer just became more convenient, faster and safer. You can receive or send money using only your UPI id. There is no need to share any personal details like IFSC Code, account number or mobile number. Moreover, there is no need for beneficiary registration, and the transactions are authorized by a secret MPIN known only to you.