Tips to keep your Paytm Payments Bank account safe

Money Mule

When people, knowingly or unknowingly, lend their bank accounts to criminals for transferring illegal/black money, then such people are known as MONEY MULES. As they become an accomplice to money laundering, they too are prosecuted by the law as criminals.

How does one commit it?

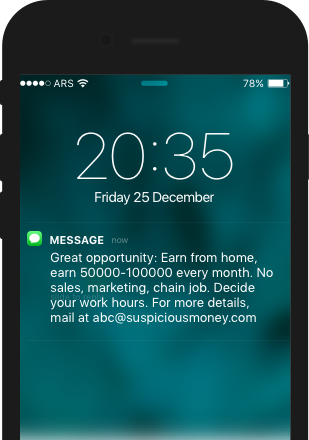

Fraudsters contact customers via emails, chat rooms, job websites or blogs, and convince them to receive money into their bank accounts, in exchange for attractive commissions. In such cases, money mules consciously choose to act as intermediaries as a way to make easy money. The fraudsters then transfer the illegal money into the money mule’s account. The money mule is then directed to transfer the money to another money mule’s account – starting a chain that ultimately results in the money getting transferred to the main criminal’s account. Fraudsters do this exercise to make it difficult for the police investigation to figure out the identity of the main criminal.

Examples

How to save myself from Money Mule?

Do's

- Review the transactions, check for withdrawals from and deposits into your bank account

- If you see any irregularity, immediately contact the appropriate authorities, viz. PPBL and/or law enforcement.

Dont's

- Do not respond to e-mails asking for your bank account details for any overseas job offer

- Do not get carried away by attractive offers / commissions or consent to receive unauthorised money