Join the Revolution.

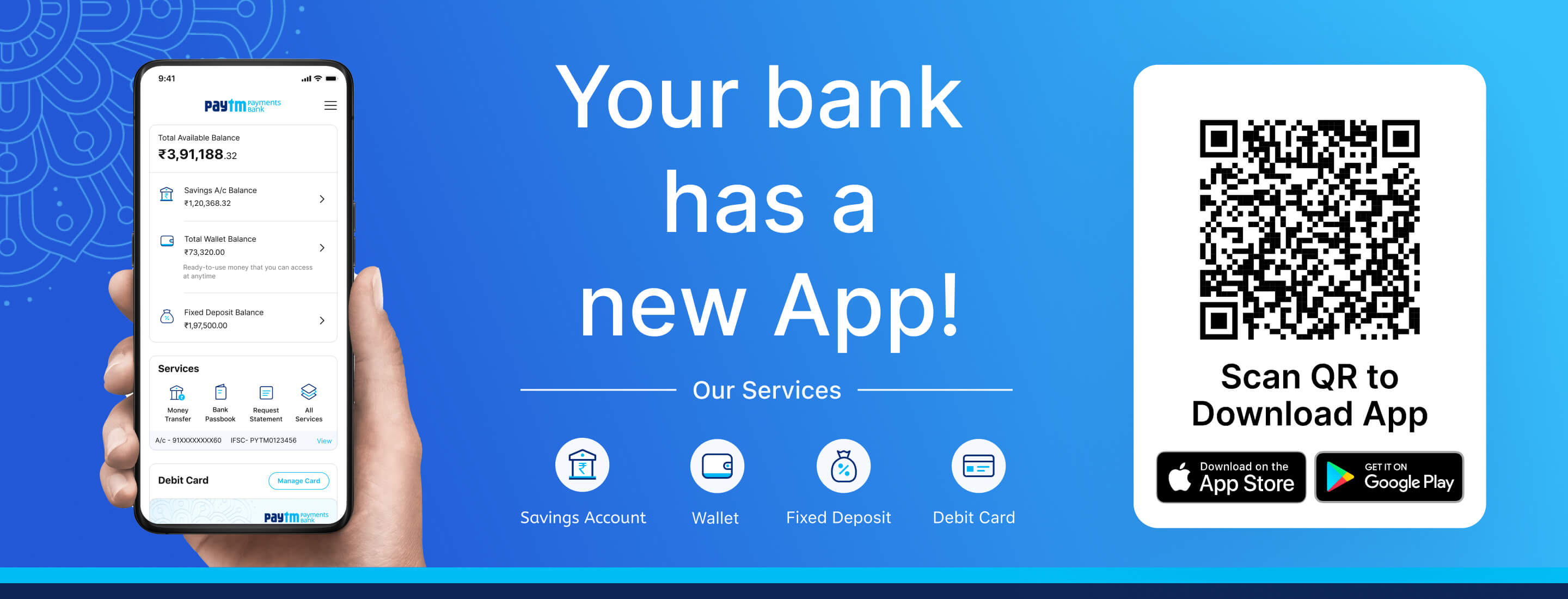

Start your Digital Savings Account today!

Paytm Payments Bank offers a Savings Account with no account opening charges or minimum balance requirements. Keep upto Rs. 2 lac of deposits and enjoy benefits like:

No account fees and charges

No account fees and chargesEnjoy the convenience of banking on your phone and no charges for online transactions

Risk-free deposits

Risk-free depositsYour money is safe with us. We invest deposits only in government bonds. None of your deposits will be converted in to risky assets.

VISA Debit Card

VISA Debit CardUse your free virtual card to make online purchases across all merchants accepting VISA cards. You can order a physical debit card through the Paytm Payments Bank section of your Paytm App

Earn interest every month

Earn interest every monthEarn an interest of 2% per annum, payable monthly effective 1st August,2023

Real time updated Passbook

Real time updated PassbookView your transaction and balance in real time in Passbook

Highly Secure

Highly SecureYour account is secured with a special Passcode to ensure your account is safe

Say hello to your

Paytm Payments Bank Debit & ATM Card

Every Paytm Payments Bank account holder will be issued a free Digital Debit Card at the time of account opening. Account holders can request for a physical Debit Card through the Paytm Payments Bank section of their Paytm App

Contactless transactions

Enjoy smart contactless Tap to Pay transactions.

Cashback and offers

Enjoy discounts and cashbacks across a large number of merchants with your

Wide acceptance

VISA is the largest acceptance network in the world

Withdraw cash from any ATM

Withdraw cash at more than 2,00,000 ATMs across India & Abroad

Trust and Security

Do safe and secure transactions 24x7

Queries regarding recent RBI directive.

What does the RBI directive mean for my Paytm Payments Bank Account/Wallet/Fixed Deposit/Transit Card? Is my money safe?

The Reserve Bank of India (RBI) has issued a directive restricting Paytm Payments Bank Account/Wallet from accepting new deposits or allowing credit transactions after March 15, 2024.

Please note that you will not be able to deposit or add money to your Paytm Payments Bank Account/Wallet after March 15, 2024. However, there is no restriction on withdrawal of money from your existing balance even after March 15, 2024.

The directive does not impact your existing balances in Account or Wallet and your money is safe with your Bank.

I have a savings or current account with Paytm Payments Bank. Can I continue to withdraw money from this account after March 15, 2024? Can I continue to use my debit card issued by Paytm Payments Bank?

I have a savings bank or current account with Paytm Payments Bank. Can I deposit or transfer money into this account after March 15, 2024?

My salary is credited into my account with Paytm Payments Bank. Can I continue to receive my salary into this account?

I receive a subsidy or certain direct benefit transfers linked to my Aadhar from the Government in my account with Paytm Payments Bank. Can I continue to receive it into this account?

My monthly OTT subscription is paid automatically through UPI from my bank account with Paytm Payments Bank? Can this continue?

I am expecting a refund in my account with Paytm Payments Bank after March 15, 2024. Can this refund be credited into my account?

The instalment (EMI) for my loan is automatically paid through my account with Paytm Payments Bank. Can this continue?

The instalment (EMI) for my loan is automatically paid through my account with a bank other than Paytm Payments Bank. Can this continue?

I have a wallet with Paytm Payments Bank. Can I continue to use money from this wallet after March 15, 2024?

I have a wallet with Paytm Payments Bank. Can I top-up or transfer money into this wallet after March 15, 2024? Can I receive money from any other person into this wallet after March 15, 2024?

I have a cashback due in my wallet with Paytm Payments Bank. Can I receive this cashback after March 15, 2024?

I have a wallet with Paytm Payments Bank. Can I close this wallet and have the balance transferred to my bank account with another bank?

I have a FASTag issued by Paytm Payments Bank. Can I continue to use it to pay toll after March 15, 2024?

I have a FASTag issued by Paytm Payments Bank. Can I recharge the balance after March 15, 2024?

Can I transfer the balance from my old FASTag issued by Paytm Payments Bank to a new FASTag obtained from another Bank?

What are the steps to close the Paytm Payments Bank FASTag?

How can I get the refund of my Security Deposit and minimum balance maintained for Paytm Payments Bank FASTag?

I have an NCMC card issued by Paytm Payments Bank. Can I continue to use it after March 15, 2024?

I have an NCMC card issued by Paytm Payments Bank. Can I add to its balance through top-up, recharge, etc. after March 15, 2024?

Can I transfer the balance from my old NCMC card issued by Paytm Payments Bank to a new card obtained from another Bank?

I am a merchant and I accept payments using a Paytm QR code, Paytm sound box or Paytm POS terminal, linked to another bank account (not with Paytm Payments Bank). Can I continue to use this set-up even after March 15, 2024?

I am a merchant and I accept payments using a Paytm QR code, Paytm sound box, Paytm POS terminal linked to my bank account or wallet with Paytm Payments Bank. Can I continue to use this set-up even after March 15, 2024?

Can I make payments through the Bharat Bill Payment System (BBPS) using my account with Paytm Payments Bank?

Can I make withdrawals from my Paytm Payments Bank account with biometric authentication under Aadhar enabled Payment System?

Can I transfer my money into my Paytm Payments Bank account through UPI/ IMPS after March 15, 2024?

Can I withdraw my money from my Paytm Payments Bank account through UPI/ IMPS after March 15, 2024?

Can I withdraw my money from my Paytm Payments Bank account through UPI/ IMPS after March 15, 2024?

What will happen to my Paytm Payments Bank account/wallet if there is a lien or freeze marked on the directions of Law Enforcement or judicial authorities?

What will happen to my Paytm Payments Bank account/ wallet if there is a lien or freeze marked on account of internal policies of Paytm Payments Bank?

What is the status of the Business restriction placed on Paytm Payments Bank vide RBI Press Release dated March 11, 2022?

All your questions answered

What is the procedure to complete my KYC?

To complete full KYC of your PPBL account, you need to complete in-person verification by visiting a nearby KYC center. To become a KYC user, please follow the link below:

How can I apply for a Debit & ATM Card?