Why do I Need to Complete KYC?

Wallet services provided by Paytm Payments Bank are governed under the RBI guidelines of pre-paid instruments. These guidelines require that for issuing Wallet to customer Minimum KYC must be completed. Further, Minimum KYC is valid for 24 months. For using Wallet beyond 24 months as well as for availing complete benefits of Wallet, Full KYC needs to be completed.

Also, for availing Savings Account services (optional) provided by Paytm Payments Bank, Full KYC needs to be completed.

Click here to complete your KYC.

Watch this video to find more about why you should do your KYC:

What is Minimum KYC and What are the Benefits of Completing Minimum KYC?

As per RBI guidelines, you to need do complete Minimum KYC to activate your wallet. In order to complete Minimum KYC you need to provide your Name and Unique identification number of any of Passport, Voter ID, Driving License or NREGA Job Card.

Minimum KYC allows you partial access to benefits of Paytm Wallet. With you minimum KYC wallet you

- Can pay to 12 Million+ Merchants who accept Paytm

- Can pay online on any app/website

- Maintain balance up to ₹10,000 per month

- Cannot send money to a friend’s wallet

- Cannot transfer money to the bank

- Cannot keep the balance of up to ₹1,00,000

- Cannot open Savings Account

As per RBI guidelines, Minimum KYC is valid for 24 months only. To get complete benefits of wallet and to continue usage beyond 24 months, you need to complete your Full KYC.

How do I Complete my Minimum KYC?

In case your Minimum KYC is not complete, you will see an exclamation mark against your Name in the flyout menu that opens from the left. Tapping on your name will take you to the profile page where you will see a banner showing you that your wallet is not active. Tapping on the banner will take you to the screen where you can provide your Name and Unique identification number of any of Passport, Voter ID, Driving License or NREGA Job Card.

On submitting these details, you will become a Minimum KYC customer and your Wallet will be activated.

Click here to complete your Minimum KYC now.

What Happens if I Don’t Complete my Minimum KYC?

Minimum KYC is required for using Wallet. Without Minimum KYC it is still possible for you to use Paytm for UPI money transfer and make purchases using credit/debit cards and net-banking.

What Happens if my Minimum KYC Expires?

As per RBI guidelines, your Minimum KYC will expire in 24 months unless you complete Full KYC with in-person verification. After expiry, you will not be able to add money to your wallet or transfer the balance amount to your bank account. You can however continue to use your existing wallet balance for making payments at 12 Million+ merchant outlets as well as online payments on apps/websites accepting Paytm. You can also continue to use Paytm for UPI money transfer and make purchases using credit/debit cards and net-banking.

How do I Know if my Minimum KYC is Complete and When is it Expiring?

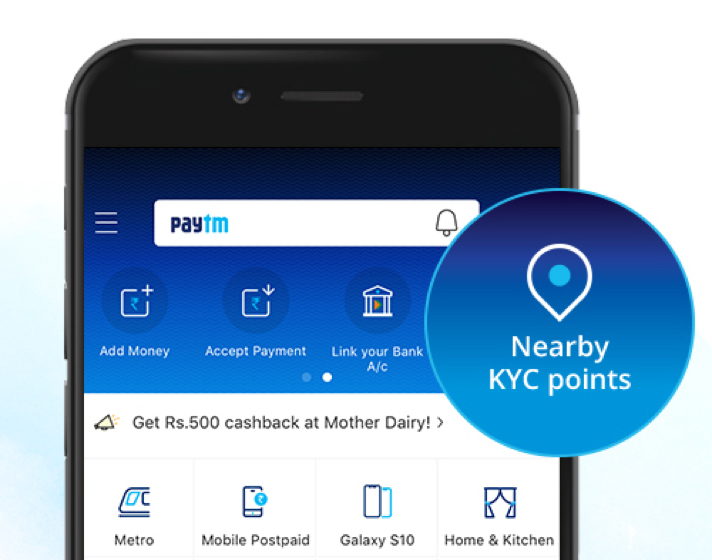

If your Minimum KYC is complete, you will see a KYC icon on Paytm Home Page on the Blue Strip at the top. On tapping on this icon you will be able to see details of your Minimum KYC expiry date. In case your Minimum KYC has expired, it will be mentioned on this screen.

What is Full KYC and What are the Benefits of Completing Full KYC?

You can become a full KYC customer once you complete your in-person verification. By becoming a full KYC verified customer, you will get the following benefits:

- The amount of money you can hold in your wallet gets upgraded from ₹10,000 to ₹1,00,000

- No spending limit on your wallet account

- You can transfer money to any other wallet or bank account

- You become eligible to open Paytm Payments Bank Savings Account

Click here to complete your Full KYC.

How do I Complete my Full KYC?

To become a Full KYC customer, you need to complete in-person verification in any of the following ways:

1. Aadhaar based KYC at your Nearby KYC Point: You can find Nearby KYC points by tapping on http://m.p-y.tm/kyc on your smartphone or visiting this link on your browser. You may also tap on the Nearby icon on the blue strip at the top of Paytm App Home page. You need to carry your Aadhaar and PAN* for verification. You will need to verify your Aadhaar biometrically.

2. Aadhaar based KYC at your Doorstep: This is in pilot phase and has been rolled out to limited users in select locations. In case you are part of the pilot exercise, you will find this option by tapping on http://m.p-y.tm/kyc Else, you may visit the KYC point nearest to your location. Please note that this will incur charges of Rs 150 per home visit.

3. KYC without Aadhaar: This facility is available only at select locations as RBI guidelines require verification of original documents to be done only by our employees. You can find the schedule of our employees by going to http://m.p-y.tm/NoBiO You will need to provide your PAN* and any ONE of the below Govt. issued Address Proof documents in original: Driving License / Voter ID / Passport / NREGA Job Card.

*In case you don’t have PAN, our representative will assist you in providing a Form 60 declaration as per RBI guidelines.

Some important points to note:

- In addition to Aadhaar & PAN, our representative will also click your picture from our authorized KYC Android app. Some additional details around parent & spouse name, occupation and income are also needed as part of CERSAI and RBI guidelines.

- Currently KYC can be done only for Indian citizens, Indian residents and Tax residents of India and of no other country.

- You can choose to use Full KYC for upgrading your Wallet & Opening Savings Account, only upgrading your Wallet or only opening your Savings Account.

Do I Need to Pay for KYC?

No. KYC is FREE. You don’t have to pay any charges to the authorized Paytm Payments Bank representaives for KYC. Although we charge a nominal fee of Rs 150 for KYC done through home visits.

Is the KYC Process Safe? Are my Documents and Photos Stored Securely? Is it safe to give my fingerprint impression for Aadhaar verification?

KYC process is completely safe and is carried out by authorized representatives who have undergone thorough background verification and intensive training. All details are captured via Paytm Payments Bank’s authorized application and are transmitted securely to our servers and are not stored on our representative’s handset. Similarly, your fingerprint impressions are not stored and are used for just a one-time verification of Aadhaar details with UIDAI. Our processes follow strict regulatory guidelines laid down for banks and are frequently subjected to external audits.

How Long Does it Take to Complete KYC Verification?

Once your in-person verification has been completed by our authorized representative, it will take another 2-3 working days to complete your full KYC verification.

How do I Check if I am a Full KYC User?

Login to your Paytm App and tap on your name in the navigation panel on the left hand side. If your KYC has been done, you will see a blue tick-mark next to your name.

Is it Necessary to Open a Savings Account if I Want to Complete my Full KYC?

No. While completing Full KYC you can choose to upgrade your Wallet & Open Savings Account, only upgrade your Wallet or only open your Savings Account. You get to make this choice yourself over an IVR call at the start of your KYC process.

What are the Benefits of Opening a Savings Account with Paytm Payments Bank?

Some of the key benefits of Savings Account are as follows:

- Zero Balance Account with 4% interest

- Auto-sweep Fixed Deposit with upto 6.5 interest

- Break FD anytime without any penalty charges

- Unlimited and FREE Bank to Bank money transfer

- FREE digital Debit Card for all your online shopping

- Platinum Debit Card/ATM card with free airport lounge access

Can Full KYC be Completed From Home?

This facility is in pilot phase and has been rolled out to limited users in select locations. In case you are part of the pilot exercise, you will find this option by tapping on http://m.p-y.tm/kyc Else, you may visit the KYC point nearest to your location.

Who is Eligible for KYC?

As per our current process, all Indian citizens, Indian residents and Tax residents of India and of no other country.

Can KYC be Done for Minors/People Less Than 18 Years in Age?

Yes, KYC can be done for minors as well.

I Have Already Completed my KYC With Online Verification of Aadhaar. Why do I Need to do KYC Again?

Aadhaar OTP based KYC is valid for only 1 year as per RBI guidelines. You need to complete your in-person verification to continue using your wallet after 1 year.

Can KYC be Done on Two Mobile Numbers? How do I Update Mobile Number Against an Existing KYC Account?

Your KYC can be done against only one mobile number.

In case you want to update mobile number against an existing KYC account, you can simply login using your existing mobile number and tap on your name in the navigation pane on the left. On the landing screen you will get an option to update your mobile number.

In case you have done your KYC on a mobile number you no longer have access to and need to get KYC done on a new mobile number please go to our 24×7 Help section and raise a ticket in the ‘I want to know the process to De-Link my KYC document’ section.

I Want to Close My Wallet and Transfer My Balance to My Bank Account. Why do I Still Need to do KYC?

This is as per the requirements of RBI Master Direction on Issuance and Operation of Prepaid Payment Instruments (Section 9.1). Minimum KYC Wallets are not allowed to transfer balance to a Bank Account. Bank transfer is enabled only post Full KYC. Full KYC is also needed in case a Minimum KYC customer wants to close account and transfer balance to Bank Account.

Click here to complete your Full KYC.

I Have Money in My Account but I am Unable to Use it. I had Already Completed KYC Using Aadhaar. Why am I Being Asked to Complete KYC Again to use Money That’s Already in my Account?

Aadhaar OTP based self KYC is only valid for one year. In-person Full KYC verification needs to be completed within one-year for uninterrupted wallet services. If Full KYC is not completed within one year, then debit and credit freeze needs to be applied on Wallet as per RBI Master Direction on KYC. In case your account has been frozen, please get your KYC done. Post successful KYC your wallet will be activated again. Click here to complete your Full KYC.

Read this blog in Hindi

Updated on 15/02/2021