Mobile payments and banking has made it easy for us to pay, shop and save our money. Now you can do any of these from anywhere in the country — our lives are so much easier now.

With advancements in technology, cyber attack methods and tools have also changed from traditional vectors like malicious software and vulnerabilities to more ingenious scams that can be deployed from unexpected regions of the world.

Here are some uncommon ways they’ll try to trick you:

1. Fake Emergency Phone Calls

A forged phone call is one such attempt where a fraudster poses as your relative or friend and asks you transfer funds immediately.

How they pull it off:

They will collect your information from social networking sites like Facebook, Linkedin, Twitter and so on. Once they have enough information, they will call you and pose as a relative or friend and talk to you about an ‘emergency’.

Once they are confident that you are sold on the idea, they will ask you to transfer some money in their bank account or Paytm Wallet citing those ‘emergency’ reasons. Once you transfer the amount, he/she will further transfer that money to some other account so that transaction cannot be reversed.

How to protect yourself:

Never share sensitive personal details on social networking sites. Also, never transfer funds without confirming a person’s identity.

2. Vishing

Vishing is an attempt where fraudsters try to seek personal information like Paytm Bank PIN, Paytm OTP, Card expiry date, CVV etc. via a phone call.

How they pull it off:

The fraudster poses as an employee from Paytm, the government or a bank and asks you for your personal information.They will cite various reasons like reward points, free cashback, reactivation of account, etc. These details will then be used to draw money from your account without your knowledge.

How to protect yourself:

Never share your personal information or financial information via SMS, call or email. Our teams will NEVER call you for such sensitive information at any point of time.

Do not login to Paytm account unless you see green padlock/secure sign, website is Paytm.com domain and it is a https website

3. Smishing

Smishing is when an SMS/Email/WhatsApp message is used to lure you into calling back on a fraudulent phone number, visiting fraud websites or downloading malicious content via your phone.

How they pull it off:

Fraudsters will send you SMSes/Facebook Requests/WhatsApp messages telling you that you’ve won some prize money, lottery, job offer and what not. They’ll ask you to share your Paytm account/Paytm Payments Bank account details. Unaware of what might happen, once you do that, they will initiate fraudulent transactions using your account details.

How to protect yourself:

Never share your personal information or financial information via SMS, call or email. Our teams will NEVER call you for such sensitive information at any point of time.

4. Identity Theft

Identity Theft occurs when someone uses your personal information to obtain a Credit Card, Loan and other services in your name. Then those will be used for fraudulent transactions.

How they pull it off:

They try to gain access to your details through Phishing, Vishing, Smishing or any other nefarious means.They will call you and try to collect your details by posing as Paytm Staff maybe!

How to protect yourself:

Never share your personal information with a stranger or any third party posing as a Paytm representative. Additionally, update your bank records whenever you change your contact numbers, address or email ID.

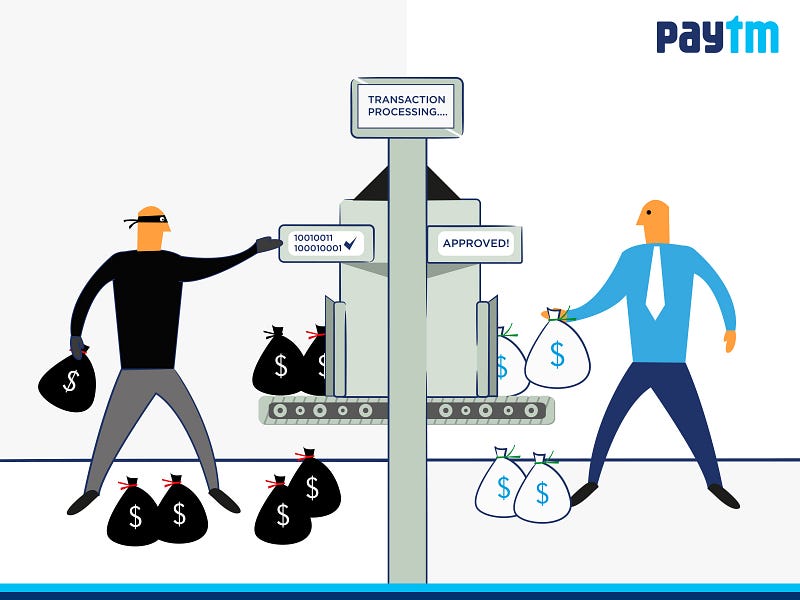

5. Money Mule

Money Mule is a term used for victims who are duped into laundering stolen/illegal money via their bank account.

How they pull it off:

Fraudsters will contact you via email, SMS or job websites, and convince you to receive money into you bank accounts in exchange of attractive commissions. They will then transfer the illegal money into your account.

They will then direct you to transfer the money to another person’s account — starting a chain that ultimately results in the money getting transferred to the fraudster’s account. This way, you will become the target of all police investigations.

How to protect yourself:

Do not respond to emails asking for your bank account details. For any overseas job offer, confirm the identity and contact details of the company first. Remember, nothing comes for free — so attractive offers/commissions might be too good to be true!